Is Mobikwik Safe? 12 Reasons to Trust Your Digital Transactions

In an increasingly digital world, mobile wallets and digital payment platforms have become an integral part of our lives. Mobikwik, one of India’s leading digital wallet and financial services providers, has gained popularity for its convenience and versatility. However, many users have concerns about the safety and security of their financial transactions on such platforms. In this article, we’ll address the burning question: Is Mobikwik safe? We’ll provide you with 12 compelling reasons to trust Mobikwik with your digital transactions.

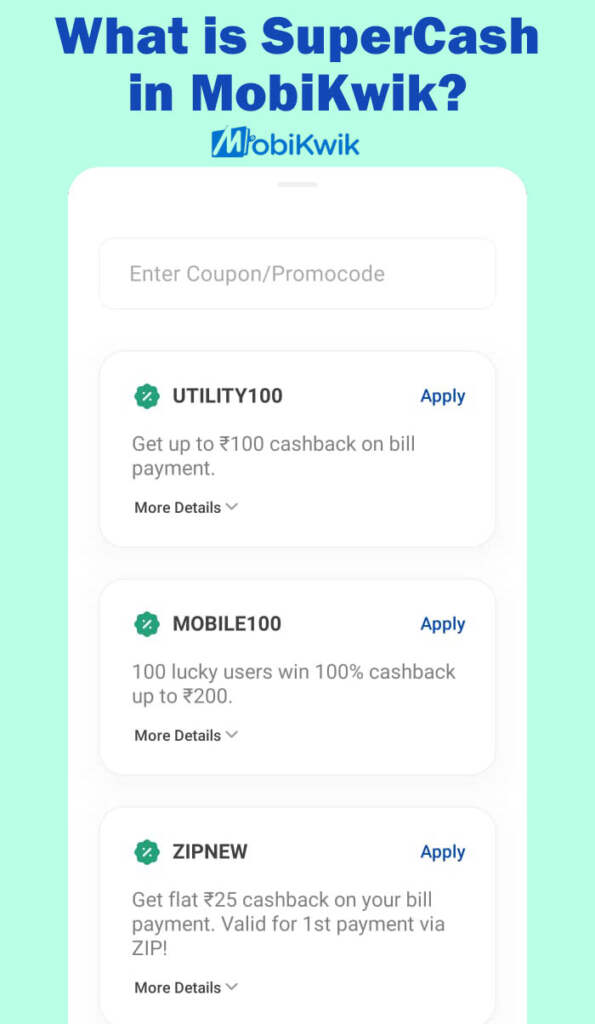

Mobikwik Referral Code

Download the Mobikwik App and Earn Cashback : Download Now

Try Mobikwik for credit card bill payments. It’s instant, seamless, and you can get Rs. 100 cashback on your first payment. You can also earn cashback rewards and access detailed spend analytics for better financial management. Give it a try!

1. RBI Authorization

One of the most significant indicators of a safe digital payment platform is its authorization by the Reserve Bank of India (RBI). Mobikwik is authorized and regulated by the RBI, ensuring that it adheres to the highest security and compliance standards set by India’s central bank.

2. PCI DSS Compliance

Mobikwik complies with the Payment Card Industry Data Security Standard (PCI DSS), a set of security standards designed to ensure the secure handling of credit card information. This compliance reflects Mobikwik’s commitment to safeguarding your financial data.

3. End-to-End Encryption

Mobikwik employs robust encryption protocols to protect your data during transmission. This means that your financial information, personal details, and transaction data are encrypted and secure while in transit, making it extremely difficult for unauthorized parties to intercept or access your information.

4. Biometric Authentication

Mobikwik enhances security by offering biometric authentication methods, such as fingerprint recognition and facial recognition, for login and transaction authorization. This adds an extra layer of protection to your account.

5. Two-Factor Authentication (2FA)

Two-factor authentication is a vital security feature that Mobikwik provides. It requires users to enter a one-time password (OTP) sent to their registered mobile number to verify their identity during login or certain transactions, reducing the risk of unauthorized access.

6. Device Binding

Mobikwik employs device binding, which means that the app is linked to a specific device. If you try to access your Mobikwik account from an unrecognized device, you’ll need to go through additional security checks, adding another layer of protection.

7. Secure Servers

Mobikwik stores user data on secure servers protected by state-of-the-art security measures. These servers are regularly audited and monitored to ensure the highest level of protection against data breaches.

8. Transaction Alerts

Mobikwik keeps you informed about your account activity by sending transaction alerts via SMS and email. This allows you to quickly detect and report any suspicious or unauthorized transactions.

9. In-App Security Features

The Mobikwik app includes security features like the ability to lock and unlock your wallet, change your password, and update your personal information. These features give you more control over your account’s security.

10. Customer Support and Grievance Redressal

Mobikwik takes customer concerns seriously and offers a dedicated customer support team to address issues and provide assistance. They have a structured grievance redressal process to resolve any disputes or complaints promptly.

11. Regular Security Updates

Mobikwik regularly updates its app and security protocols to stay ahead of evolving threats. These updates may include bug fixes, security patches, and enhancements to ensure the platform remains secure.

12. Transparent Privacy Policy

Mobikwik maintains a transparent privacy policy that outlines how user data is collected, used, and protected. Being open about their data practices builds trust among users concerned about their privacy.

Related Articles

Conclusion

In answer to the question, “Is Mobikwik safe?” – the evidence strongly suggests that it is. With RBI authorization, PCI DSS compliance, end-to-end encryption, biometric authentication, and a host of security features, Mobikwik is committed to providing a secure platform for digital transactions. While no system is entirely immune to threats, Mobikwik’s comprehensive security measures and commitment to user safety make it a trusted choice for millions of users across India. When using Mobikwik or any digital payment platform, it’s essential to follow best practices for online security, such as regularly updating your password, enabling 2FA, and monitoring your account activity for any unusual transactions.